After a serious car accident, you may be wondering how insurance policy limits come into play and are asking: “What Happens if Medical Bills Exceed Policy Limits?”

Typically, No-Fault coverage provides payment for medical bills for treatment of related injuries. Additionally, a claim can be made against the at-fault vehicle’s liability policy for threshold meeting injuries.

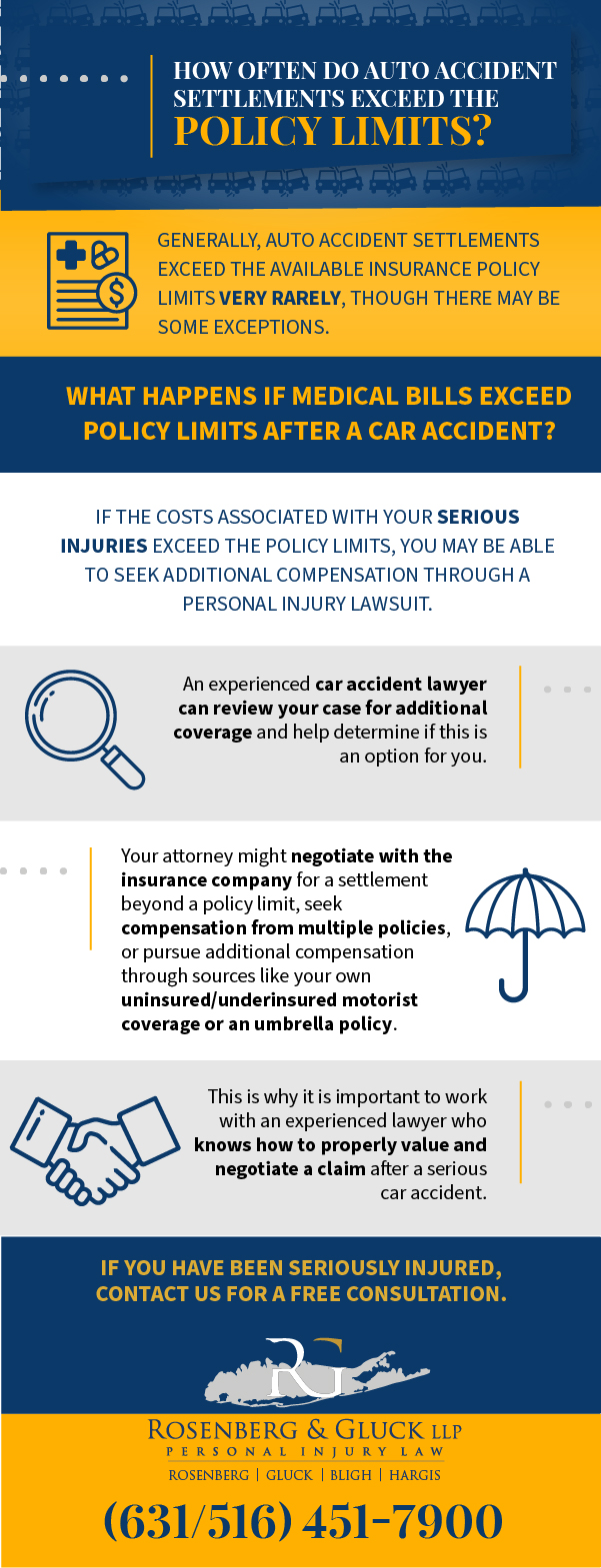

Generally, auto accident settlements exceed the available liability insurance policy limits very rarely, though there may be some exceptions.

Auto insurers often prefer settling cases out of court cheaply, prioritizing their bottom line over your well-being. Expenses from serious injuries can add up to exceed policy limits, so it’s crucial to discuss your case with an experienced Long Island personal injury attorney who can help to maximize your financial recovery by looking at all available insurance.

For a free legal consultation, call 631-451-7900

New York Requires Drivers to Carry Auto Insurance

According to the New York State Department of Financial Services (NYSDFS), all drivers in New York must carry the following types of auto insurance policies and meet the minimum coverage requirements:

Basic No-Fault or Personal Injury Protection (PIP)

No-fault insurance (also known as PIP insurance) covers basic economic losses for the driver, passengers in the car, or a pedestrian who was hit, no matter who caused the accident.

It provides up to $50,000 in coverage per person for medical expenses, lost wages, and direct expenses related to the crash.

It does not cover any property damage, including vehicle repair or replacement. It also does not cover non-tangible losses including pain and suffering.

If you were hurt in a car collision, typically the PIP insurance from your own insurance company will cover your bills before your health insurance kicks in.

Liability Insurance Coverage Minimums

Liability insurance provides financial compensation for personal injury, death, and property damage from the at-fault driver to the victim(s).

If you were injured in a collision caused by another driver, their liability insurance should cover your losses beyond PIP, including pain and suffering.

New York’s minimum insurance requirements are:

- $25,000 for any injury or $50,000 for any injury resulting in death to one person in one collision

- $50,000 for injuries or $100,000 for injuries resulting in death by two or more people in any one collision

- $10,000 for property damage to the vehicle or other personal property in any one collision

Uninsured Motorist Insurance

Uninsured motorist insurance covers bodily injuries to you and resident relatives if you’re hurt in a car accident by a driver without insurance or by a hit-and-run driver.

This type of coverage only provides compensation for bodily injury, not property damage. The minimum coverage is the same 25/50/10 as the minimum coverage for liability.

Additionally, this coverage often encompasses supplemental underinsured motorist coverage, which can provide additional insurance in car accident settlements if your injuries exceed insurance limits on the available at-fault party’s insurance.

Click to contact our personal injury lawyers today

What If My Expenses Exceed the Policy Limits?

If the costs associated with your serious injuries exceed the full policy limits of both your PIP insurance and the liability insurance policies, you may be able to seek additional compensation through a personal injury lawsuit.

An experienced car accident lawyer can review your case for additional coverage and help determine if this is an option for you. Your attorney might negotiate with the auto insurance company for a settlement beyond a policy limit, seek compensation from multiple policies, or pursue additional compensation through sources like your own uninsured/underinsured motorist coverage or an umbrella policy. This is why it is important to work with an experienced car accident claim lawyer who knows how to properly value and negotiate a claim after a serious car accident.

Economic Losses

You can sue the other driver for economic losses beyond the minimum no-fault insurance coverage limits including:

- Medical care such as surgeries, rehabilitative treatments, medical equipment, prescription medication, and more

- Lost wages for your unpaid time out of work while you recover

- Future lost wages if you cannot return to your previous occupation

Pain and Suffering for a Serious Injury

You can sue the at-fault party for your pain and suffering caused by the crash if your injury meets New York’s injury level requirements, detailed in Insurance Law § 5102(d).

These types of “serious injury” to an accident victim include:

- Death

- Dismemberment

- Significant disfigurement

- Fractured bones

- Loss of a fetus

- Permanent loss of use of a bodily organ, member, function, or system

- A temporary medical injury or impairment that disrupts regular daily activities for 90 to 180 days after the accident

If your losses or damages exceed policy limits of the at-fault driver’s insurance policy, you can pursue fair compensation by taking the case to trial and potentially obtaining a judgment. The other driver’s insurance may offer a settlement, though these rarely exceed limits of most auto insurance policies.It is important to have an experienced personal injury attorney on your side to aggressively negotiate for you to seek full compensation for your injuries.

Complete a Free Case Evaluation form now

How Much Time Do I Have to File an Auto Accident Case in New York?

There are time limits for filing a personal injury lawsuit in New York. Generally, under CVP § 214, accident victims have three years from the date of the accident to file car accident claims seeking compensation for losses.

You have two years to file a wrongful death claim per EPT § 5-4.1.

In some cases, like against a municipal entity, you might have just 90 days to act. If you wait too long to file a claim, you may be barred from recovering any compensation at all.

Rosenberg & Gluck, L.L.P., is Ready to Represent You After an Auto Accident

If you were injured in a car accident, the experienced auto accident attorneys at Rosenberg & Gluck, L.L.P. are ready to provide aggressive representation to seek compensation for you. We are experienced in handling complex auto accident cases, and have a proven track record of success in obtaining maximum compensation for our clients.

Free Case Evaluation

Call us for a free consultation with a personal injury lawyer to discuss your case and learn how we can assist you.